Medicare Premiums Deducted From Social Security Payments 2024. Most medicare beneficiaries have this premium deducted from their social security benefits. In 2024, beneficiaries of the medicare part a inpatient hospitalization insurance program will see a modest increase in the inpatient hospital deductible.

Most medicare beneficiaries have this premium deducted from their social security benefits. In 2024, the base monthly premium for medicare part.

In Many Cases, You Can Have Your Medicare Premiums Deducted From Your Social Security Check.

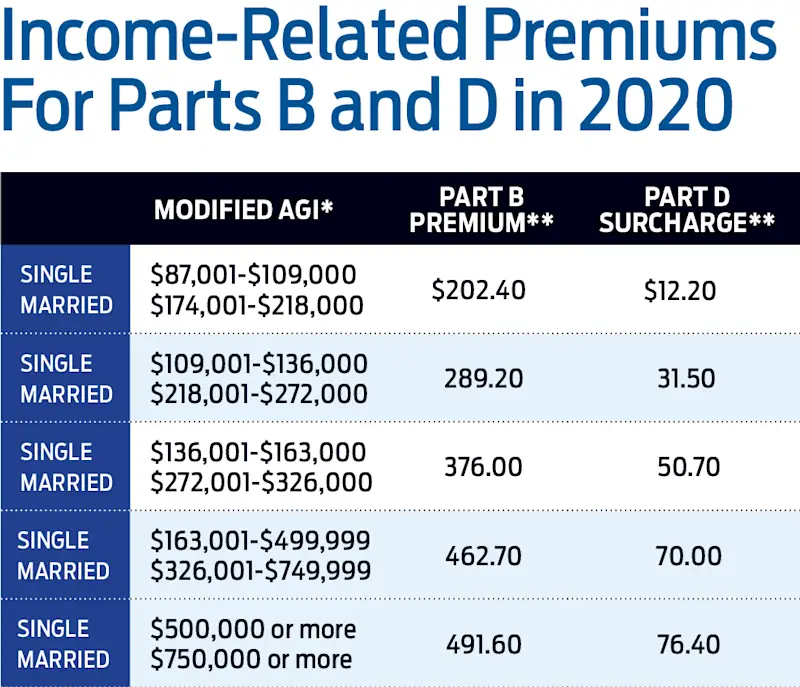

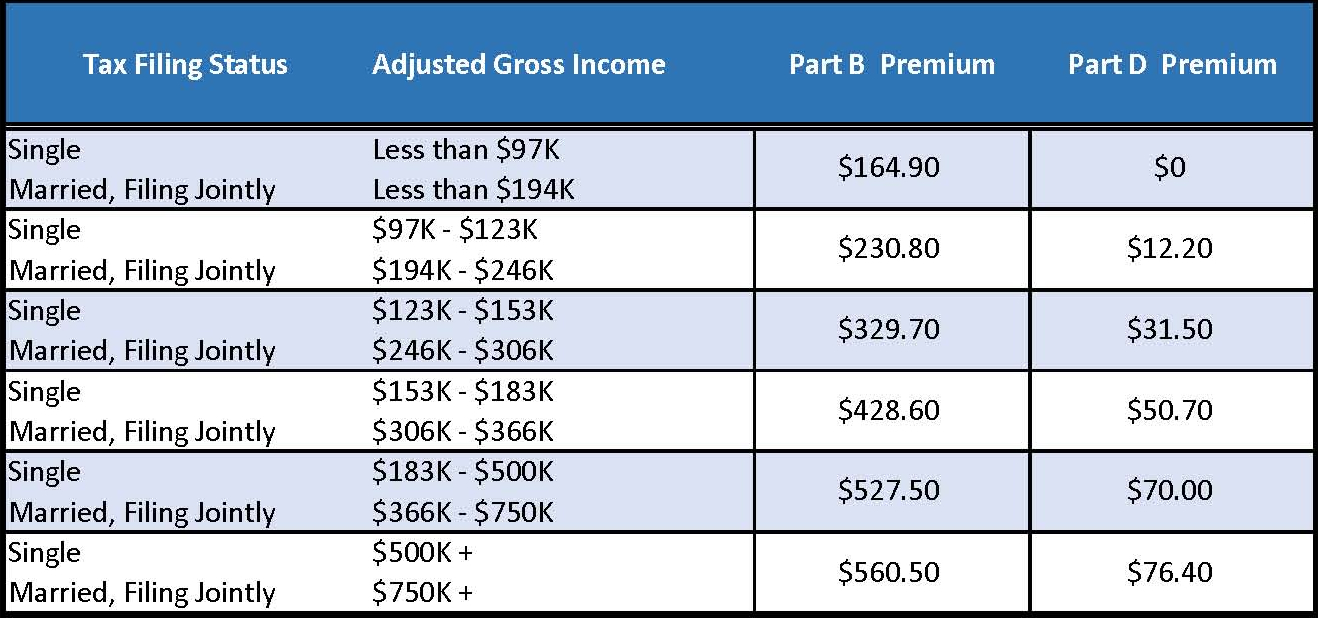

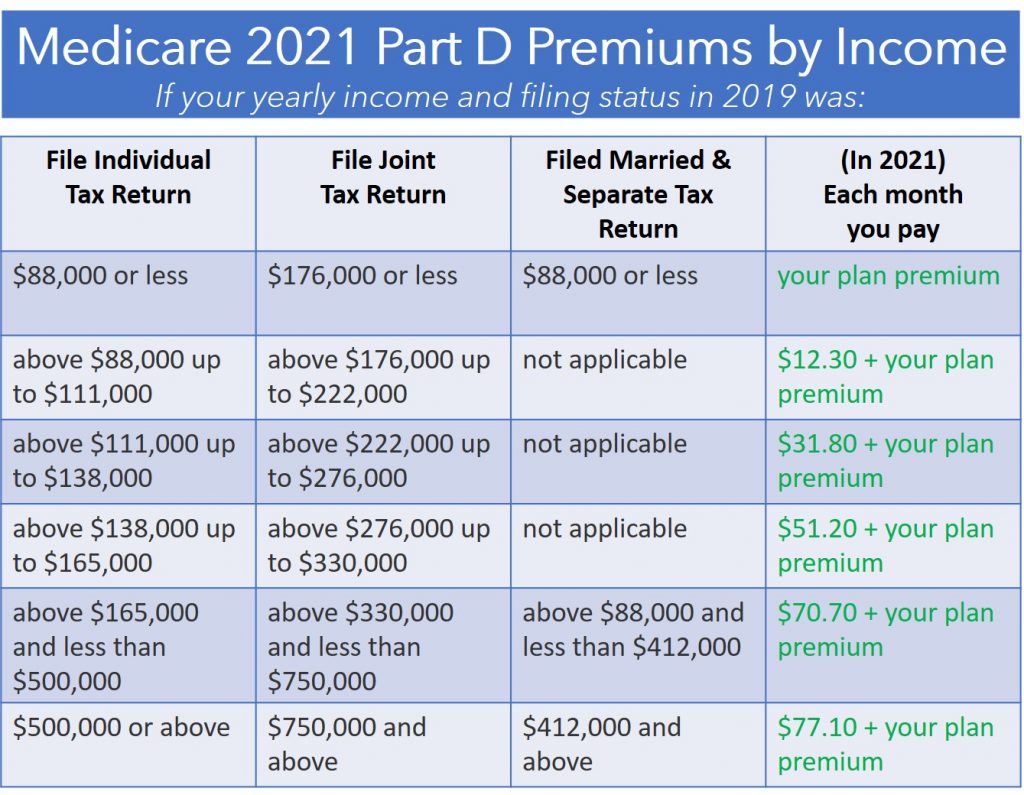

Here are the 2024 irmaa amounts for married taxpayers that file separately:

In 2024, The Base Monthly Premium For Medicare Part.

In 2024, medicare beneficiaries with reported income of more than $103,000 (filing individually) or $206,000 (filing jointly) in 2022 pay from $244.60 to $594 a month for part b.

If You Receive Social Security Retirement Or Disability Benefits, Your Medicare Premiums Can Be Automatically Deducted.

Images References :

Source: www.medicaretalk.net

Source: www.medicaretalk.net

How Much Will Medicare Premiums Increase In 2022, Also, the annual part b deductible will rise to $240 in 2024, an increase of $14. Here are the 2024 irmaa amounts for married taxpayers that file separately:

Source: smedleyfinancial.com

Source: smedleyfinancial.com

Social Security in 2023 Smedley Financial Blog, Here are the 2024 irmaa amounts for married taxpayers that file separately: In 2024, medicare beneficiaries with reported income of more than $103,000 (filing individually) or $206,000 (filing jointly) in 2022 pay from $244.60 to $594 a month for part b.

Source: boomerretirementbriefs.com

Source: boomerretirementbriefs.com

2023 Medicare Part B Premiums Just Released…, The premium amount will be taken out of your. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Source: medicare-faqs.com

Source: medicare-faqs.com

What Is The Standard Medicare Premium For 2020, For 2024, if your income is greater than $103,000 and less than $397,000 the. In 2024, the base monthly premium for medicare part.

Source: www.healthline.com

Source: www.healthline.com

When Are Medicare Premiums Deducted from Social Security?, For 2024, if your income is greater than $103,000 and less than $397,000 the. What determines the medicare premium.

Source: www.medicaretalk.net

Source: www.medicaretalk.net

Are Medicare Advantage Premiums Deducted From Social Security, If you receive social security retirement or disability benefits, your medicare premiums can be automatically deducted. In 2024, the standard medicare part b premium deducted from social security benefits is projected to be around $170.10 per month.

Source: clearmatchmedicare.com

Source: clearmatchmedicare.com

Can Medicare Part D be Deducted from Social Security? ClearMatch Medicare, If you receive social security retirement or disability benefits, your medicare premiums can be automatically deducted. Can medicare part b premiums be deducted from social security?

Source: what-benefits.com

Source: what-benefits.com

When Can I File For Medicare Benefits, The premium amount will be taken out of your. Here are the medicare premiums, deductibles, and copay amounts for 2024.

Source: www.pinterest.com

Source: www.pinterest.com

When Are Medicare Premiums Deducted from Social Security? in 2022, We tie the additional amount you pay to the base beneficiary premium, not your own premium amount. The average monthly social security payment will increase by $59 a month.

Source: www.medicaretalk.net

Source: www.medicaretalk.net

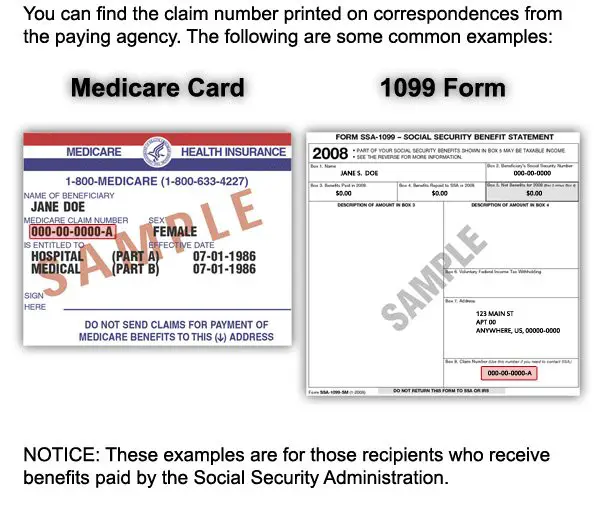

How To Check My Medicare Number, In 2024, you'll also pay a $1,632. Irmaa does affect your social security benefits, but in one specific way:

If You Receive Social Security Retirement Or Disability Benefits, Your Medicare Premiums Can Be Automatically Deducted.

In 2024, the standard medicare part b monthly premium will be $174.70.

If You’re Single And Filed An Individual Tax Return, Or Married And Filed A Joint Tax Return, The Following Chart Applies To You:

Whether or not you can deduct your medicare premiums — and which ones you can deduct — depend on a couple of factors: